Experts in a given field have enough experience accumulated during their years of work in the industry they handle to predict and address with certain ease some points of view that could go unnoticed by others.

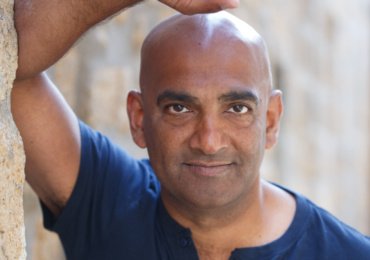

Paul Carassone, known as The Property Boss, is a real estate investor and an expert in real estate. He runs a property management company (Carassone Property Management) and a property maintenance company. In addition, he provides real estate consulting and training.

For those who may be wondering, Mr. Carassone has predicted, among other things, the Williamsburg real estate boom in the 1990s, the Beacon City real estate boom in the early 2000s, and the market crash in 2008.

“I have been investing for over 24 years in the real estate industry. I have seen that a lot of misinformation is now being taught to people who are potential investors in real estate.” Mr. Carassone shares.

This led Mr. Carassone to enter the teaching and mentoring space. He fears that much of this misinformation being taught will not only hurt these investors but will also hurt the real estate market.

The commercial office space market has already started to see significant declines, and Mr. Carassone expects that trend to continue well into the end of 2023 and into 2024.

“This is a consequence of people’s unwillingness to return back to the office space for work. This will leave landlords with leases and vacant space that cannot be occupied.” Mr. Carassone shared, when asked about the prospects for the real estate market in 2023.

Due to the looming outlook of a global recession, Mr. Carassone believes that there will be far fewer international buyers interested in acquiring real estate compared to what was seen in recent years.

“This will reduce the number of international investors who have been investing in the U.S. real estate market since the last recession.” He adds.

Mr. Carassone estimates with regard to the multifamily real estate sector, that rents will have to come down due to inflation as people will not be able to afford these exorbitant rents. Rents will also have to come down to fill vacancies. This may be one of the ingredients for a bigger problem when lending resets and properties are unable to generate income.

“Add to this higher interest rates, and owners will find themselves with their properties upside down and cash flow at rock bottom. These properties will not be able to appraise at the value needed to reestablish the loan. Low appraisal and low rents, coupled with higher interest rates, will be the perfect storm for owners to default on their loans and lose their properties.” Mr. Carassone explains.

Even though things may not look good for the real estate market in 2023, Mr. Carassone offers an encouraging outlook for savvy and, above all, patient investors. He states that this will be a generational time to buy and build a portfolio.

To learn more about Paul Carassone, click here.